Finance is the management of money and includes activities such as investing, borrowing, bending, etc. It is the study of management and the process of acquiring needed funds.

What is Finance?

The account is a broad term that portrays exercises related to banking, influence or charge, credit, capital business sectors, ventures, and cash. Finance also encompasses the oversight, creation, and study of money, banking, investments, credits, assets, and liabilities that make up financial systems.

Undoubtedly, Finance is one of the important aspects of the business. With huge funds, daily cash flow, and continuous transaction, managing and monitoring all of the above term necessary. To be specific, financial management helps the organization determine what to spend, where to spend, and when to pay. Business finance‘s importance is to make sure business has sufficient capital for long- and short-term needs and to evaluate the cost Money is a significant and unavoidable capacity in any place, and proficient budgetary administration is critical for progress.

Which are the primary areas of Finance?

The basics of Finance are as follows:

1. Corporate Finance

The division of Finance deals with how corporations deal with funding sources, capital structuring, and investment decisions. Corporate Finance is fundamentally worried about augmenting investor esteem through long and transient budgetary arranging and the usage of different strategies. A corporate account is a region of money that centers around the financing and estimating partnerships, including capital designation, resource financing, and expanding esteem.

Corporate Finance includes:

- Real options valuation

- Risk management

- Investment in stock

2. Public Finance:

Public Finance is the investigation of the function of the administration in the economy. It is the part of financial matters that evaluates the administration income and government use of the public specialists. The change of either to accomplish desirable Public account guarantees that the revenue created is conveyed similarly to the economy and securities’ distinctive monetary area.

Government income:

1.Public losses

2.Economic power

3.Country’s Debt

Public Finance includes:

- Determining the source of funds

- Tax management

- Issuing debts for public projects

- Sources of income for the general element.

3. Personal Finance

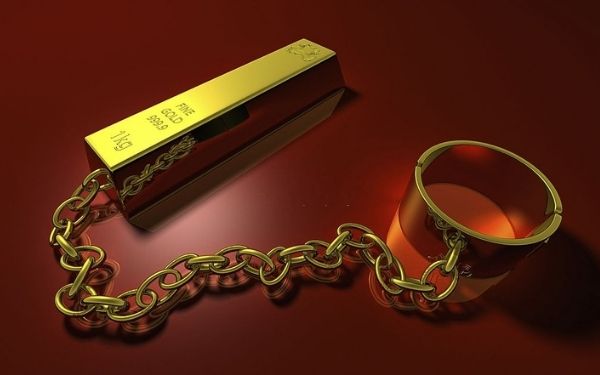

It envelops planning, banking, protection, contracts, ventures, retirement arranging, and expense and bequest planning. Personal monetary aptitudes are significant because, without them, individuals typically go through their whole lives slaving for cash, consistently paying off debtors, always unable to get up to speed, and get ahead.

Personal Finance includes:

- Safety against uncertain private events.

- Transfer of income across families.

- Preparing for retirement.

- Giving money for deficits and loans.

- Investment

Read More : “Manifest Money |10 Ways To Do It Fast”

What are the features of Finance?

1.Channelizing funds

The monetary area and budgetary business sectors play out the basic capacity of diverting assets from individuals who have spared excess assets by spending not exactly their pay.

To individuals who have a deficiency of investible holdings due to their arrangements to spend surpass their income.

2.Allocation & Utilization of Funds

Finance, as a capacity, identifies with the designation and utilization of assets. A business needs to make sure that the right funds are available at the right price at the right time and with the right resources. It needs to decide the technique for raising assets, regardless of whether it involves protections or loaning to a bank. Once the assets are presented, the assets must be designated for different undertakings and administrations. Finally, the business’s motivation is to make a benefit, which depends on how productively and successfully the assets are allocated. The legitimate utilization of investments depends on ideal speculation choices, appropriate control, and resource the executive’s arrangements, and proficient administration of working capital.

3.Maximization of Shareholder’s Wealth

Shareholders’ wealth maximization suggests that a business concern should consider the choices that augment the offer’s market estimation or the investors’ wealth. When the firm raises the investors’ riches, the increased investor can utilize it to expand his utility.

How does Finance work?

The budgetary framework’s critical elements are to encourage homegrown and corporate reserve funds, apportion these assets to their best use, oversee and appropriate danger, and encourage payments. The money related area is improving when it does it at a lower cost and makes the economy’s remainder better.

In general, the account serves a significant financial purpose. By all accounts, the framework is turning out better for organizations that appreciate simple admittance to obligation and value markets. With the advancement of expert administration, the development of institutional capital and private value in late many years has helped improve money circulation.

Specifically, investment has built up an energetic business area that has changed enterprises, such as data innovation and interchanges, and made new organizations, such as online retailers and biotechnology. Businesses supported by Venture Capital have also put pressure on existing firms to adapt and innovate their business models.

FAQs

What is the purpose of Finance?

The reason for the account is to help individuals spare, oversee, and raise money. Finance needs to have its motivation articulated and accepted. Students in capital ought to learn it in their business instruction.

What are the three sources of Finance?

A business account’s wellsprings are value, obligation, debentures, held income, term advances, working capital advances, letters of credit, euro issue, adventure financing, etc. These wellsprings of resources are used in different conditions.

Which is the most expensive source of Finance?

Financing through value is the costliest type of money in the long haul, especially when you are another business.

What is taught in Finance?

A few tracks that account majors frequently decide to zero incorporate International Finance, Capital Markets, Risk Management, and Corporate Finance. More comprehensively, a money degree will instruct understudies to investigate the vacillations and changes in the development and stream of cash, the estimation of money, and return of ventures.

Conclusion

The money includes the evaluation, exposure, and monetary action board and is basic to firms’ and markets’ productive activity. Finance is the main part of the economy. Managing and observing the entirety of the above defining moments, with capital assets, long and momentary assets, and stock exchanges. Finances have an impact when it comes to making decisions.

0 Comments